If you did your homework and came to the conclusion that gold bull market is not over yet, and will continue to appreciate against the currencies it is measured, then silver is a leveraged way to play gold. This is because throughout history, silver follows the direction and outperforms gold in percentage terms on the way up. The downside is, it has an equal effect on the way down. It is widely referred to as gold on steroids, so trade and invest carefully!

Another thing to note is the gold to silver ratio. Currently 1 oz of gold is equal to 62 oz of silver. People that have studied history will know that this ratio will eventually need to return to 15. Ie 1 oz of gold is equal to 15 oz of silver. Silver has a lot of catching up to do and is undervalued when priced against gold given the historical ratio and deserving some thought when choosing between gold or silver.

Saturday, May 25, 2013

Wednesday, May 22, 2013

Tuesday, May 21, 2013

Price of silver in the early 15th century- surpassed $1200 per ounce!!!

In the early 15th century, the price of silver is estimated to have surpassed $1,200 per ounce, based on 2011 dollars. The discovery of massive silver deposits in the New World the succeeding centuries has been stated as a cause for its price to have diminished greatly.

Source:

http://en.wikipedia.org/wiki/Silver

Source:

http://en.wikipedia.org/wiki/Silver

Monday, May 20, 2013

Sunday, May 19, 2013

Is the world about to run out of silver?

In the latest, May 2013 Silver Bullion Newsletter, Gregor Gregersen answers some questions regarding Bullion supplies:

Is the world about to run out of silver?

Ans: Not necessarily. The extreme silver tightness is for investment grade Silver Bullion as opposed to silver in general. Mints and refineries simply do not have enough manufacturing capacity to convert raw silver into coins and bars. Silver grains (used by industry) and rough 1,000 oz poured bars are still available.

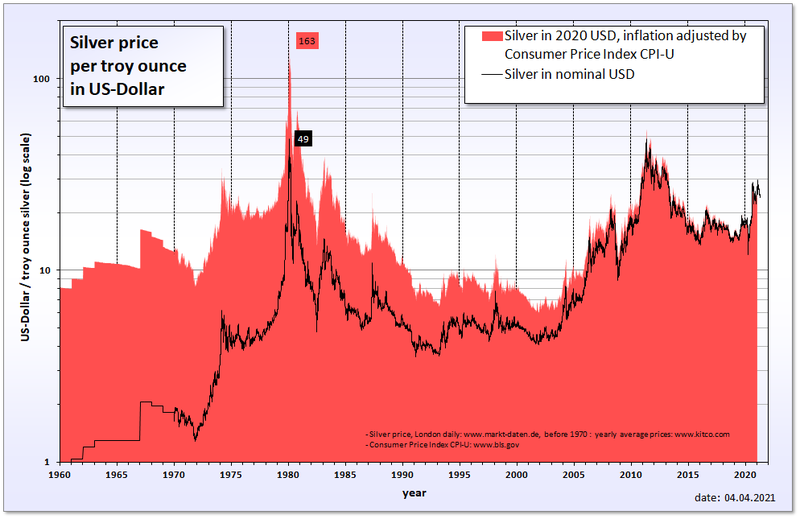

Keep in mind however that futures exchanges normally hold less than 3% in physical reserves of their net long positions. So if a major investor or bank were allowed to take a large physical delivery we could easily see an all out scarcity or market cornering as occurred in the late 1970s when physical silver was bid up to almost 50 USD (250+ USD in today's currency after adjusting for inflation).

Is the world about to run out of silver?

Ans: Not necessarily. The extreme silver tightness is for investment grade Silver Bullion as opposed to silver in general. Mints and refineries simply do not have enough manufacturing capacity to convert raw silver into coins and bars. Silver grains (used by industry) and rough 1,000 oz poured bars are still available.

Keep in mind however that futures exchanges normally hold less than 3% in physical reserves of their net long positions. So if a major investor or bank were allowed to take a large physical delivery we could easily see an all out scarcity or market cornering as occurred in the late 1970s when physical silver was bid up to almost 50 USD (250+ USD in today's currency after adjusting for inflation).

Subscribe to:

Comments (Atom)